New on LowEndTalk? Please Register and read our Community Rules.

All new Registrations are manually reviewed and approved, so a short delay after registration may occur before your account becomes active.

All new Registrations are manually reviewed and approved, so a short delay after registration may occur before your account becomes active.

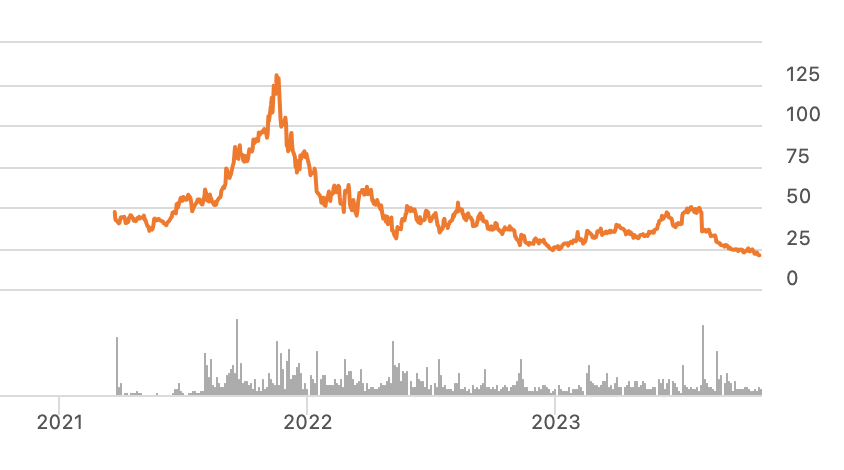

Anyone own DigitalOcean stock? If so, my condolences...

raindog308

Administrator, Veteran

raindog308

Administrator, Veteran

in General

Comments

Shame, they have good blog guides on Linux concepts and stuff

I only used their VPS services like 1.5 years ago. What has happened?

They're not popular enough for enterprise customers, not cheap enough for hobby enthusiasts. Cloud is super competitive and it's hard to keep and maintain users in the long term if they're not deploying long term projects on their cloud platform.

Anyone own NexusBytes stonks?

If so, our condolences…

Yes, they spend a lot to develop their managed services.

However, in the tech industry, they are rarely used in production.

They don't offer as many managed services as the 3 leaders AWS, Azure, Google cloud. And their products aren't the most suitable for creating your own infrastructure at attractive prices, like OVH / Hetzner for example in Europe.

I guess they're a bit in between.

On top of that, nobody wants to take the risk if the neighbors are using AWS....Why take the risk of choosing the outsider?

In short, I think they're going to have a hard time.

Sell and buy Cloudflare stock.

anyone had dedipath stocks ? i still have from hostingsolitions they are for sell

Why, did you check there HeartBeat recently. It has solid 100% uptime.

Then how about Linode bought by Akamai ?

I have the feeling that Hetzner expanding in the USA might have contributed to this decline.

Hmm. Hetzner causing a bug dent to DO? Hmmm

I have personal complaints about DO that have to do with my leaving (no offense to Ben, it had no relation to him), and the reason I say that is because I feel like it sets the stage nicely to say that I don't have the incentive to speak positively about them. Which, I think, makes this reply more interesting:

They acquired Paperspace. They added DDOS protection. They've added more droplet types. They solved many complaints by making backups independent of droplets (4-week lifespan). You may not see them as being on top of their market, but I think they're going in the right direction.

As well as Cloudways for $350m last year, and a few others over the years.

I don't think slow steady growth is going to make DO investors happy...not if they want to keep that tech multiple. As a steady-run-rate business, they're losing money...the only way to sell the story is if they're rapidly expanding, which they aren't.

There's always EIG

To buy or to buy them?

With a market cap of $1.6bn and $800m in cash, you'd think DO would be ripe for acquisition...but they've got $1.6bn in debt. They added $1.2bn in 2021...I don't remember why. It's grown more since then. Their balance sheet is interesting to say the least. $450m in goodwill, probably from Cloudways.

Akamai will absorb digitalocean as it did with linode.

Few beers and i thought why Not buy 20x Just for fun.

Just did it a few mins ago for fun

My loss cant be Big.

Wish me luck. Maybe im rich soon

I bought quite a bit in May 2021 at around $42 and sold in Oct at $81. I do that with most tech-related stock at opening. The only stock I have never sold is APPL.

No wonder, I had absolutely horrible experience with paperspace. and its a service that does not know if its cloud gaming or not.

I had shit password (in some recent email+password data leak) with them back in 2018, I know my fault since I forgot the account even existed.

But the fact whoever logged in was able to just change the password + recovery email without any confirmation from my already registered email is dumb.

They kept my card details from 2017 and it took them 48h+ to suspend the hacked account even though I called them and sent multiple emails and even had ongoing tickets. I got 58 SMS messages from my bank about attempting to charge me as whoever had the account kept making more and more services.

They were so fucking bad it makes my wonder why it even took this long for the stock to crash.

I killed the card pretty fast but I was worried that the unauthorized user would setup something bad under my name since the company was incompetent to stop anything from happening.

They wont need to.

Only third world countries use abuse it with the 200€ free credit system.

The thing will implode on itself since as stated before, its too expensive for normal users and too cheap/shit for companies. Only academies and professors advertise it during some courses due to the free credit system, so if they remove that too, nobody will use them.

When you start off learning Linux and/or developing you'll likely start by using DO/Vultr/Linode

And after that, as stated above, likely not that much more

Linode might be the exception since they have Akamai's infrastructure behind them, could probably do some bandwidth-oriented managed products that are suprior to DO/Vultr

i am waiting for @jar to say something.

Vultr always been better

If you’re going to intentionally give Dave an erection, you better be willing to deal with it.

To me it looks like they've only really lost perhaps 50% of what they were in 2022. Thats a bubble for sure of someone slowly buying a large stake or a hype train of small individual buyers that can't be maintained. overall I count this as them retaining their current size rather than growing which looks poor for investors which in turns causes many to sell.

They've lost 50% of what they were in August 2023.

I honestly can't believe how anyone would want to hold a small IaaS player

DO was a way for "startups" to get their hosting in a simpler way but the basics suite of AWS has become easy enough for startups by now, especially with Lightsail

If you want managed stuff, the big clouds is where it's at

If you don't, what you're after is basically a commodity (CPU, RAM, memory, network) in a market where getting started is cheap

Also, they now complete with cheap non-big-three clouds that OWN their own DC's

Hetzner's monthly costs per hypvervisor including the space, the staff, electricity, as so on, will be so much more efficient compared to DO with contracts with different DC's all around the world

In a few years, I also think that OVH's cloud offerings will be closely resembling Hetzner in easy-of-use and price/performance (they have what it takes to get there, even though they're definitely not there yet)

And they have their own DC's but all around the world, even including APAC

DigitalOcean isn't that interesting anymore

It was, however, a pioneer

It's hard to really pinpoint how DO is that much better compared to:

etc

First thing I did at the last startup I worked for was moving everything from DO to Hetzner

Saved a ton of monthly costs right away

He's not wrong though. It follows the NYSE graphs pretty closely, especially this year. I don't see this as any more commentary on their business as I do on the market. You're counting it from this year's big spike to the current dip, and you'll see something relatively similar on the graph for the NYSE during the same time frame. Just means they're not really special IMO, no one is holding out for them to rocket to the moon. But I mean, it's kind of a weird stock to buy for long term anyway unless you've got a horse in the race.

Last two years, $DOCN in yellow: