New on LowEndTalk? Please Register and read our Community Rules.

All new Registrations are manually reviewed and approved, so a short delay after registration may occur before your account becomes active.

All new Registrations are manually reviewed and approved, so a short delay after registration may occur before your account becomes active.

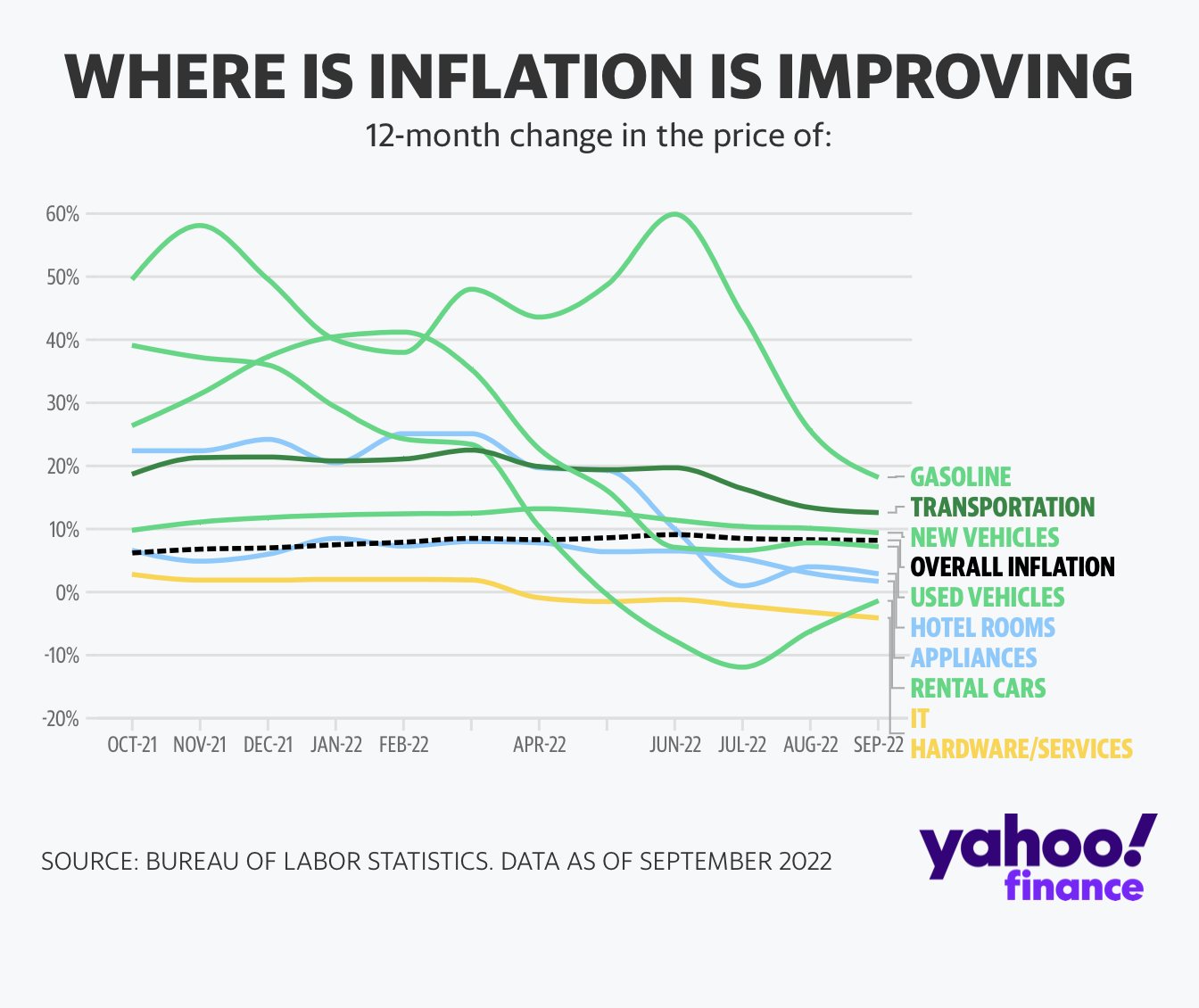

Deflation in the IT Sector

raindog308

Administrator, Veteran

raindog308

Administrator, Veteran

in General

Ignoring Yahoo Finance's lamentable quality control in chart titles, I expect that we should all be paying less for our LEBs these days...right?

Comments

That chart sure needs an update, because I know for a fact that gas prices went up well over a dollar per gallon in my area (Los Angeles) just in the past 2 weeks alone. And I haven't seen prices for anything else going down in the past few months either. Things just quietly continue to get expensive, so as usual, the government is falsifying numbers to make the administration look good again.

Edit: I'll know deflation is happening when McDonalds brings back their 2 for $3.50 instead of 2 for $4 as it is at the moment.

Your problem is the title and not the five GREEN, two BLUE and two YELLOW lines? Did they know colours are free and there's more than a few?

Current Avg. $3.913 $4.373 $4.689 $5.189 $3.229

Yesterday Avg. $3.922 $4.375 $4.691 $5.160 $3.235

Week Ago Avg. $3.867 $4.309 $4.626 $4.883 $3.186

Month Ago Avg. $3.707 $4.151 $4.462 $5.001 $3.028

Year Ago Avg. $3.288 $3.624 $3.901 $3.495 $2.817

Yes, the prices went up last month about 5%. Compared to the last year, though, as the graph shows, the 16% increase is about right. This is YoY and last year in the autumn the prices were going up already as the post-covid recovery was already gathering pace and the oil sector was suffering due to very low oil prices of the last year (2020) and the subsequent underinvestment.

The hardware deflation is also YoY. After the supply shocks of 2021 and chip scarcity, the prices remained mostly flat, but at a very high level. So, 3-4% decrease, as the supply issues are easing, is nothing to crow about. On the other hand, the other supply issues are still causing major trouble pushing the prices up as they take longer to fix as opposed to the technological sector which is more nimble by default, but it will all calm down soon enough as the markets adapt, 6-12 months at most.

"Deflation" will be then decried all over, people will cry about the economic "meltdown" forgetting to check the employment rates and wages growth once again, because, in the past, deflation came only due to a very serious recession.

The crises of the past are NOT a guarantee for the crisis of today, this is a very different animal caused by lack of supply not demand. Supply is fixable as we learn to save more and more not only due to price, but also because we have a finite planet and we must learn to grow differently than producing and throwing away more stuff.

This will happen more often in the future, scarcity of materials and fossil energy will force us to adapt, invent new materials, new sources of energy, even new food. We were too lazy to adapt in time when we were warned about it, we will have to do it abruptly, under fire.

gasoline over here is like 50-60% over year ago. same goes for diesel. We've infact seen moments when gasoline is cheaper than diesel.

IT Hardware -> Supply woes easing up, end of mining helps. But there are still shortages abound, quite a lot infact. Some items are jumping like 40% up and down what we need for servers.

It was expected that prices start to fall around this time regardless. So even if overally a few % in the negative, compared to ATH high prices for many parts (or complete unavailability) a few % lower over year ago is nothing. We should be seeing more like -30%

Energy crisis guarantees all IT Services heavily depending upon energy prices (servers) will increase sooner or later. Some businesses have very long term contracts and the power company is eating the cost difference, others have short contracts. Energy prices have also cumulative effects, because network operators also depend a lot on electricity prices and have HUGE overhead multiplying factors for it as well, depending upon setup. Routers can take A LOT of electricity, then add long range lasers etc.

Some services where the OpEx (operational expenses such as electricity, housing, bandwidth) are just a small fraction of overall don't need to increase their prices.